• HECM Reverse Mortgages (Government Insured FHA): $1,149,825 • Jumbo Reverse (Private Label): $4,000,000 (higher loan amounts require exceptions based on market conditions) • Jumbo Reverse-Standalone Second Trusts: $4,000,000

Jan 09, 2024 | Lending Limit increase Jumbo Reverse Second Trust VA LOAN Reverse Mortgage HECM Reverse Mortgage VA Low Score Jumbo Reverse Mortgage

Explore the advantages of the VA Loan program. The VA Loan program is one of the most flexible loan programs available in today’s market and is specifically designed for Active Duty, Veterans and Surviving Spouses. Some of the many benefits for eligible

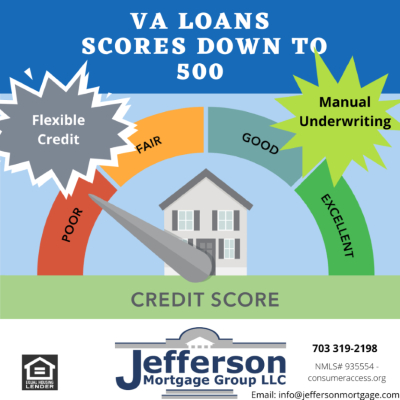

Mar 06, 2023 | VA Low Score VA LOAN manual underwrite Credit Score down to 500 Low Credit Score

The increase in rates has restored a level of balance back into the real estate market for the traditional VA Loan Veteran or Active Duty borrower. This has been missing for several years as the predominant seller’s market has shunned the request of the

Feb 03, 2023 | VA Low Score VA LOAN mortgage Housing Market Real Estate Market 2023 changes Seller Contribution Low Credit Score

Get prequalified! Learn what your actual representative credit score is and don’t be fooled by the low-priced reports or credit services because many times these scores provided are not accurate. They also may not be the representative scores that will be

Oct 25, 2022 | mortgage self-employed borrower VA LOAN

Most veterans are relegated out of the VA Loan Program by the marketplace for having lower credit scores and credit related issues. Many lenders shy away from VA borrowers with less than 620 credit scores and others have instituted underwriting overlays

Mar 03, 2020 | mortgage VA Low Score VA LOAN manual underwrite